UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

The Securities

Exchange Act of 1934

(Amendment No. )

_____________________________

Filed by the Registrant x[X]

Filed by a Party other than the Registrant ¨

[ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

o[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

| Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] Definitive Proxy Statementx

| Definitive Proxy Statement |

[ ] Definitive Additional Materials¨ | Definitive Additional Materials |

[ ] Soliciting Material Pursuant to Section 240.14a-12¨ | Soliciting Material Pursuant to §240.14a-12 |

Principal Variable Contracts Funds, Inc.PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all the appropriate box)boxes that apply):

¨ | Fee computed on table below[ ] Fee paid previously with preliminary materials.[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 2) | Form, Schedule or Registration Statement No.: |

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

650 8th711 High Street

Des Moines, Iowa 50392-208050392

January 25, 2012March 6, 2023

Dear Contract Owner:

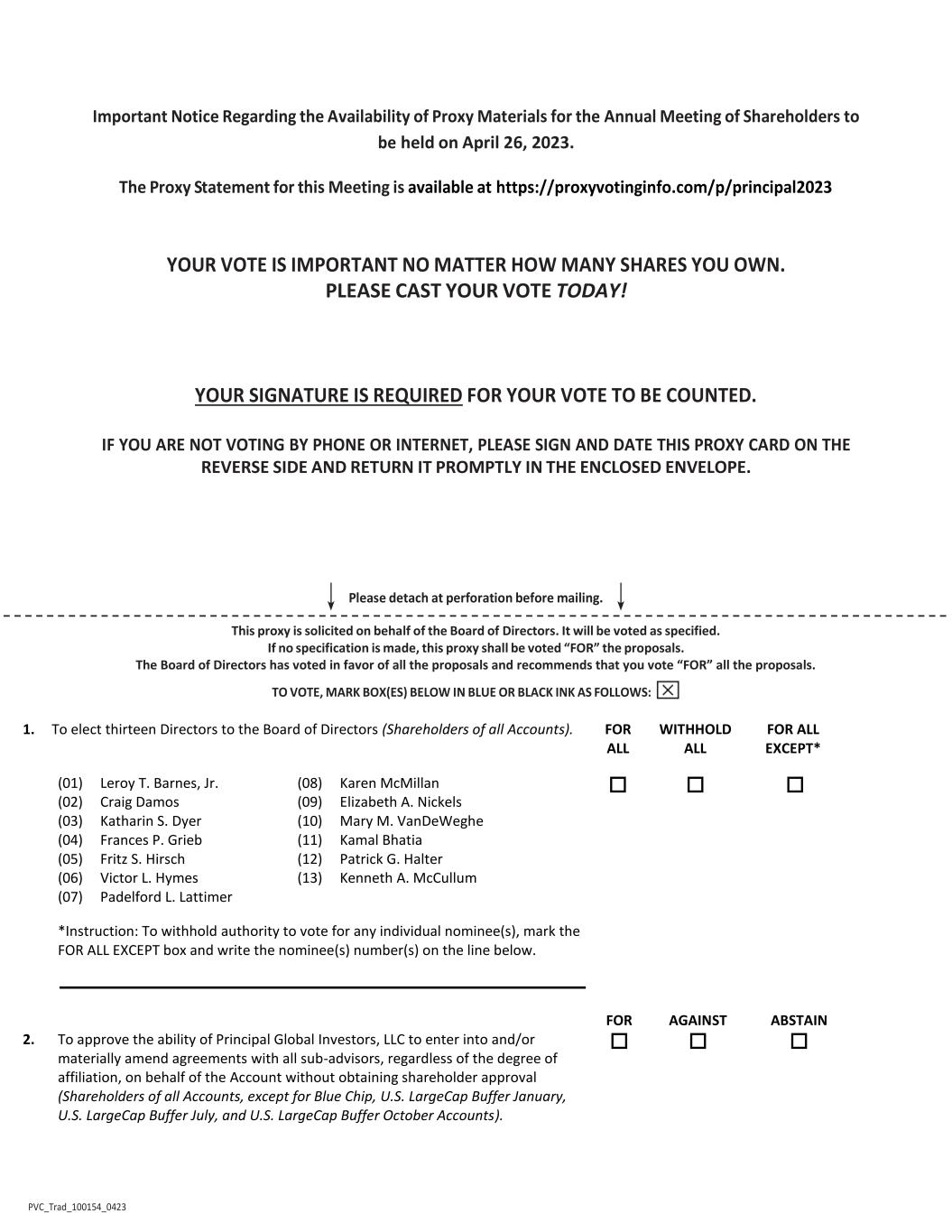

The BoardWe cordially invite you to attend a joint annual meeting of Directorsshareholders (including any adjournments or postponements, the "Meeting") of each series of Principal Variable Contracts Funds, Inc. (“PVC”("PVC") has called a special meeting, Principal Funds, Inc. ("PFI"), Principal Exchange-Traded Funds ("PETF"), and Principal Diversified Select Real Asset Fund ("PDSRA"), all investment companies registered under the Investment Company Act of shareholders of all the separate series or funds of PVC (each a “Fund”1940, as amended, and collectively, the “Funds”) for advised by Principal Global Investors, LLC, on April 4, 201226, 2023 at 10:00 a.m. Central Time, at 650 8th Street,801 Grand Avenue, Des Moines, Iowa 50392-208050392.

The enclosed proxy materials relate to only PVC and are being sent only to the PVC shareholders that owned shares of any series of PVC (each an "Account" and, collectively, the "Accounts") as of the close of business on February 27, 2023, the record date for the Meeting (the “Meeting”"Record Date"). The purposeAccounts' shareholders of the Meeting is to elect the Board of Directors, including three nominees for new Directors,record are insurance company separate accounts that offer variable life and to consider several other proposals.

Shareholders of all the Fundsvariable annuity contracts.You are being asked to approve:

| § | The election of fourteen Directors as members of the Board of Directors. |

| § | Amended and Restated Articles of Incorporation, reflecting, among other things, recent changes in the Maryland General Corporation Law. |

| § | Amended fundamental investment restrictions relating to: |

Senior securities;

Commodities;

| Real estate;

Making loans;

| Diversification; and

Concentration

|

| § | Elimination of the fundamental investment restriction relating to short sales. |

As an investor in the Funds throughreceiving these materials because you own a variable annuity contract or variable life insurance policy issued by an insurance company that is a shareholder of record, and you have allocated the contract value of such contract or policy to one or more Accounts. As a result, you have the right to instruct your insurance company how to vote the shares of the FundsAccounts that represent your contract value. Your insurance company will vote, in accordance with your instructions, the number of FundAccount shares that represents that portion of your contract value invested in each of the FundsAccounts as of January 6, 2012, the record dateRecord Date.

PVC shareholders that owned shares of any series of PFI or PETF, or shares of PDSRA, as of the Record Date will separately receive proxy materials for PFI and/or PETF and/or PDSRA. References in these proxy materials to a "Account" or the "Accounts" and the "Board of Directors" are to PVC Account(s) and the PVC Board of Directors, respectively, unless otherwise indicated.

The purpose of the Meeting (the “Record Date”).for PVC shareholders is to elect the Board of Directors, including four nominees for Independent Director who have not previously been elected by shareholders and two nominees for new Interested Director, and to consider one other proposal, in addition to the transaction of such other business as may properly come before the Meeting.

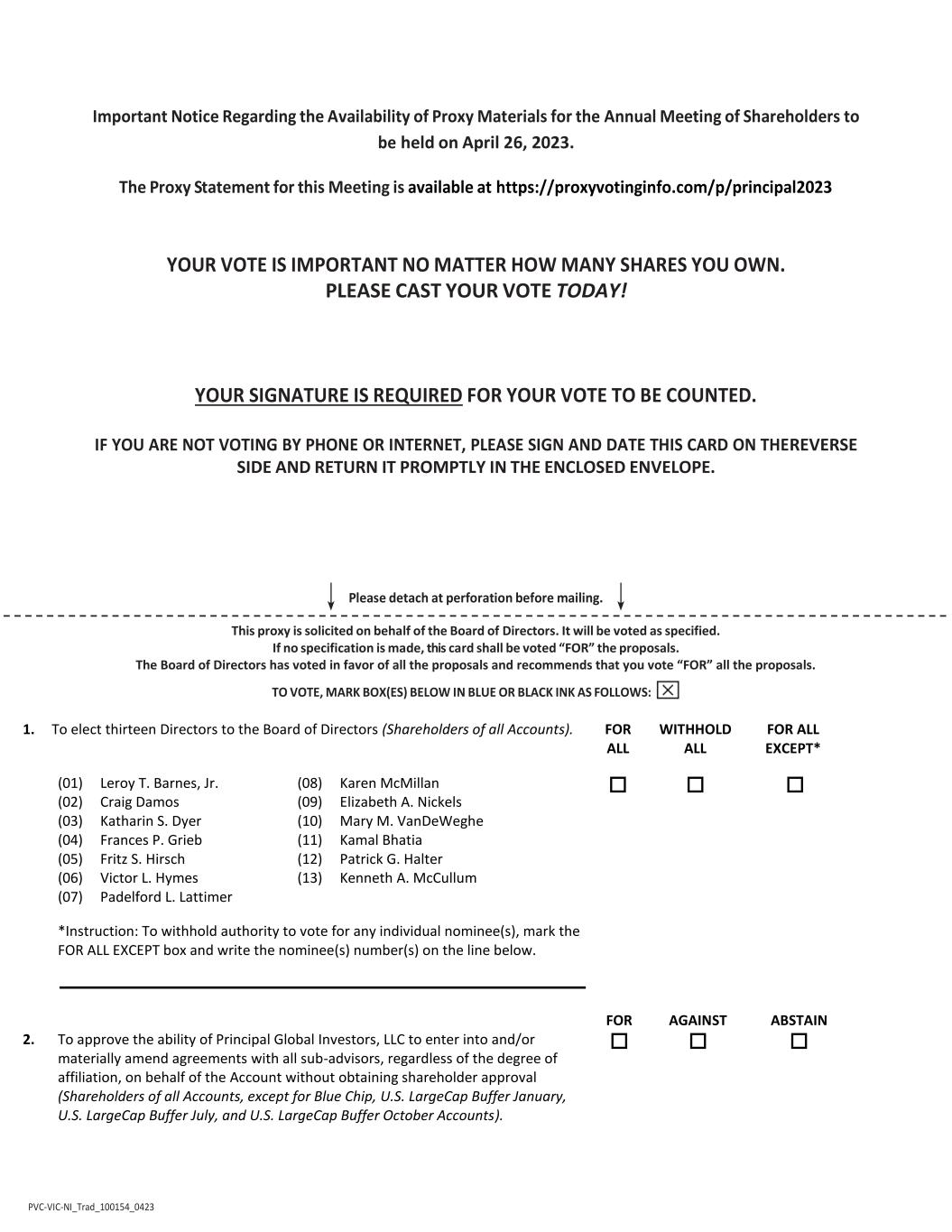

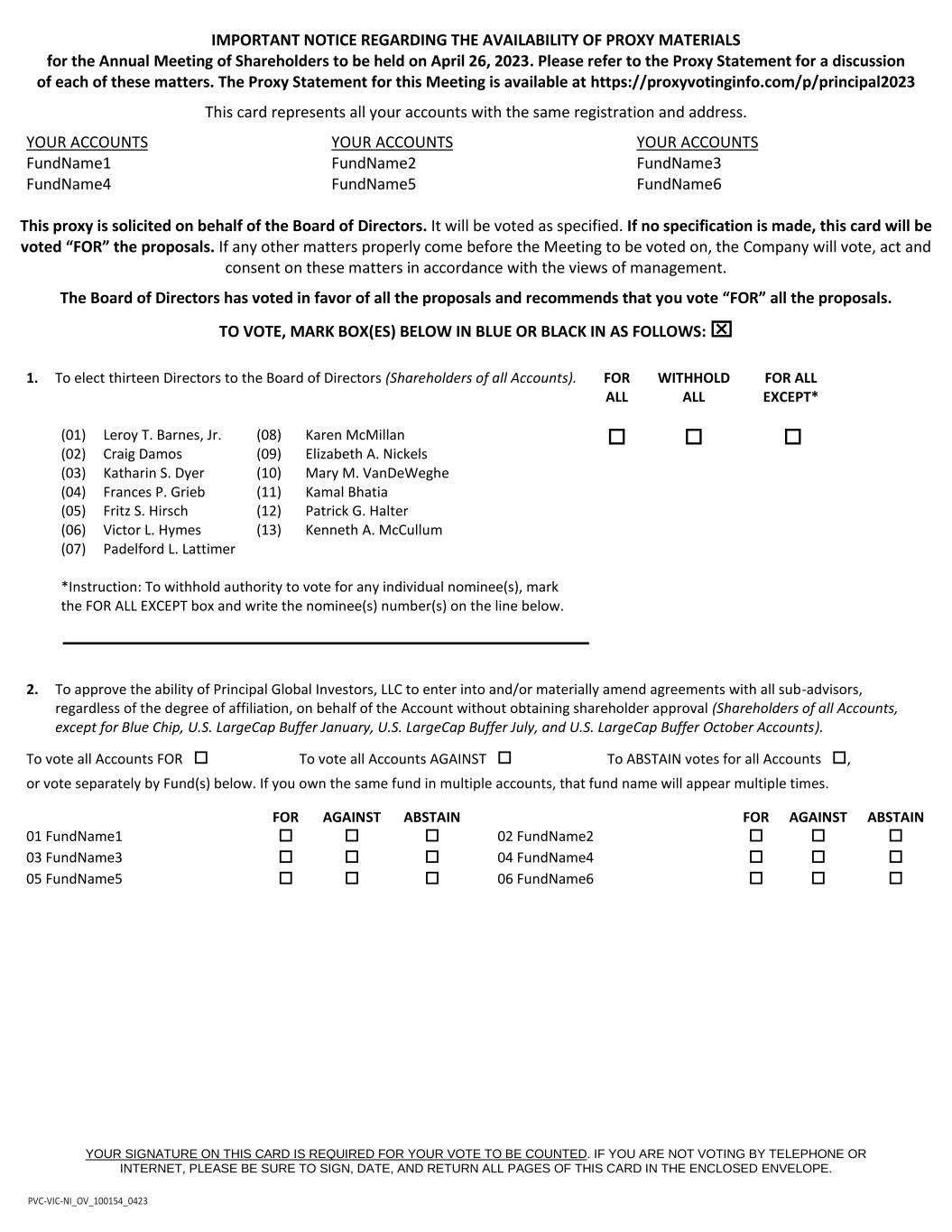

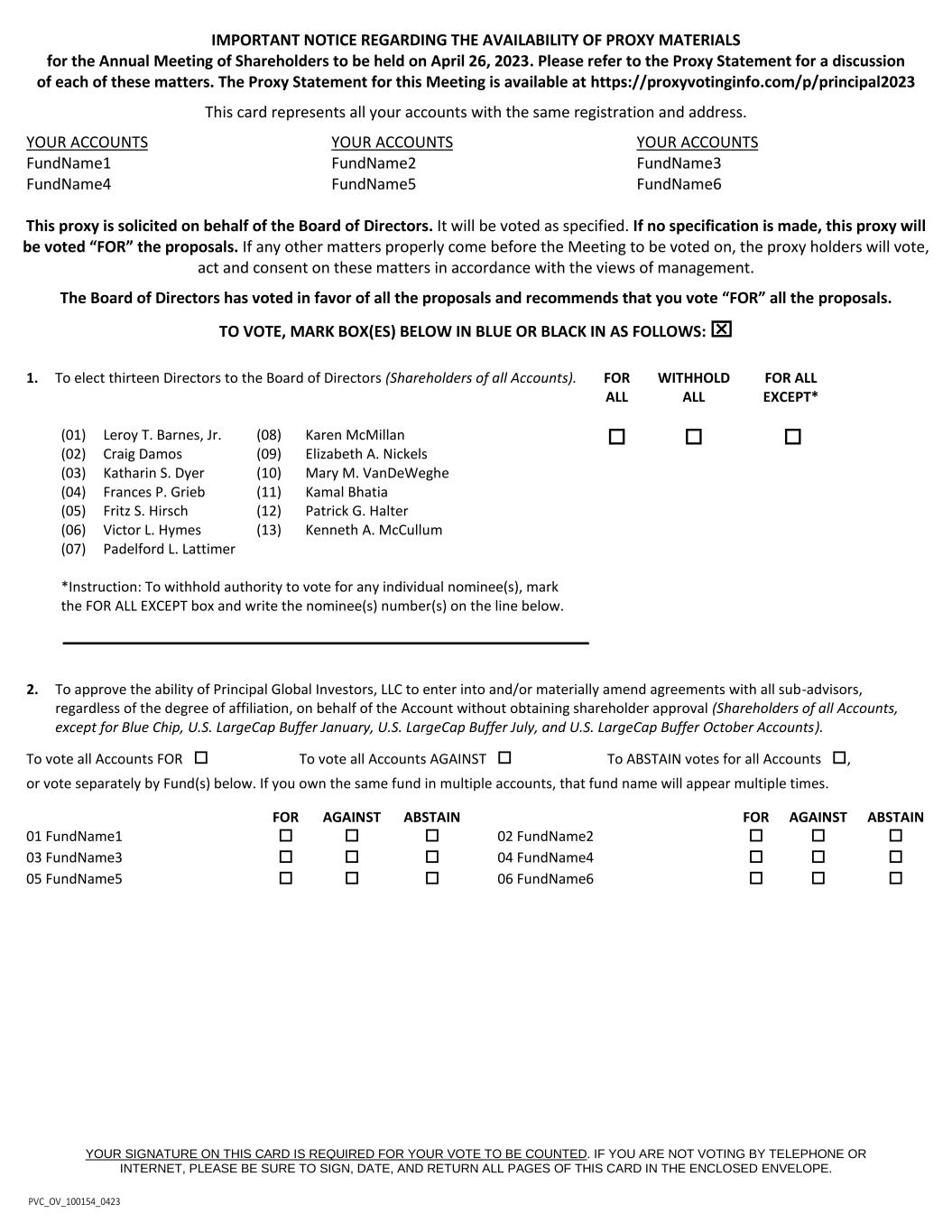

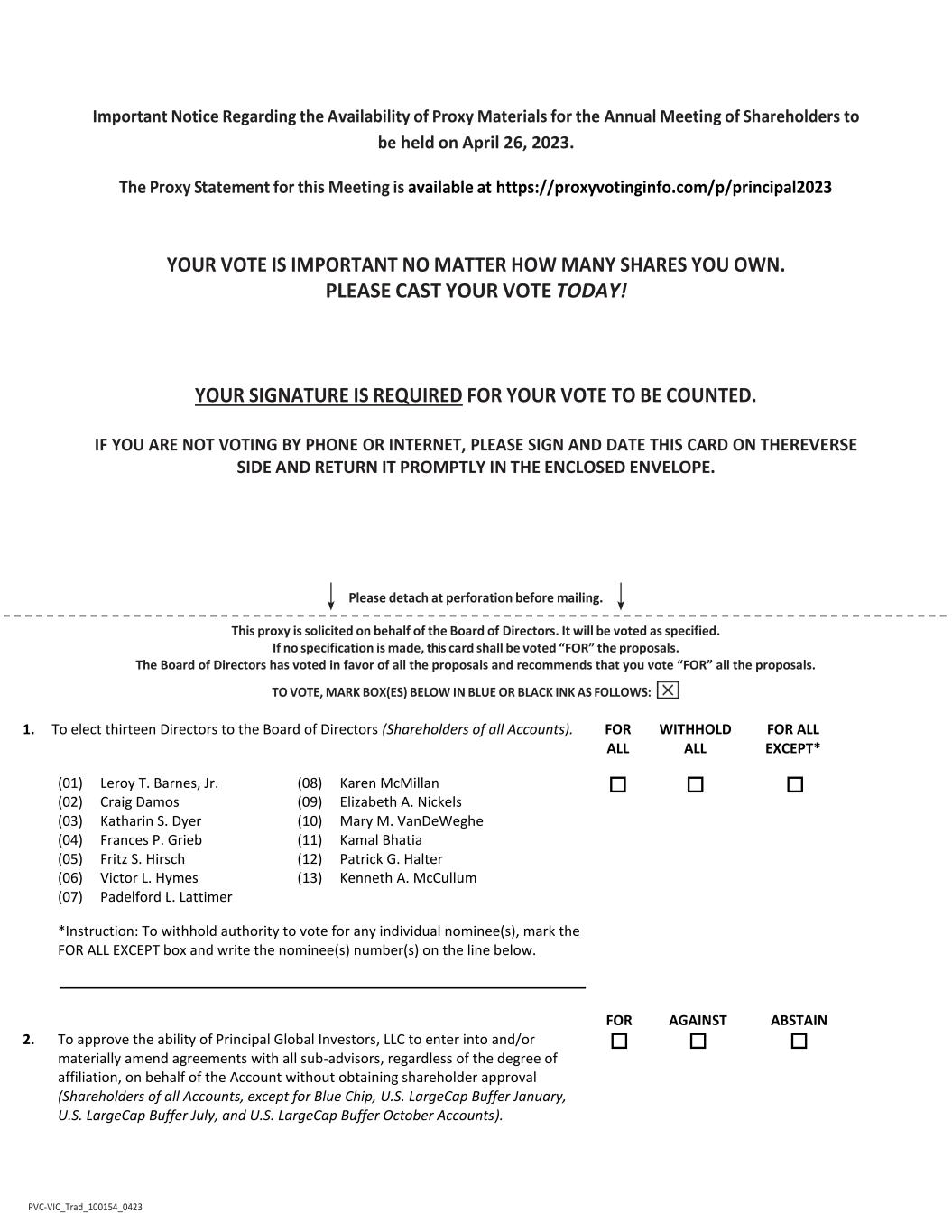

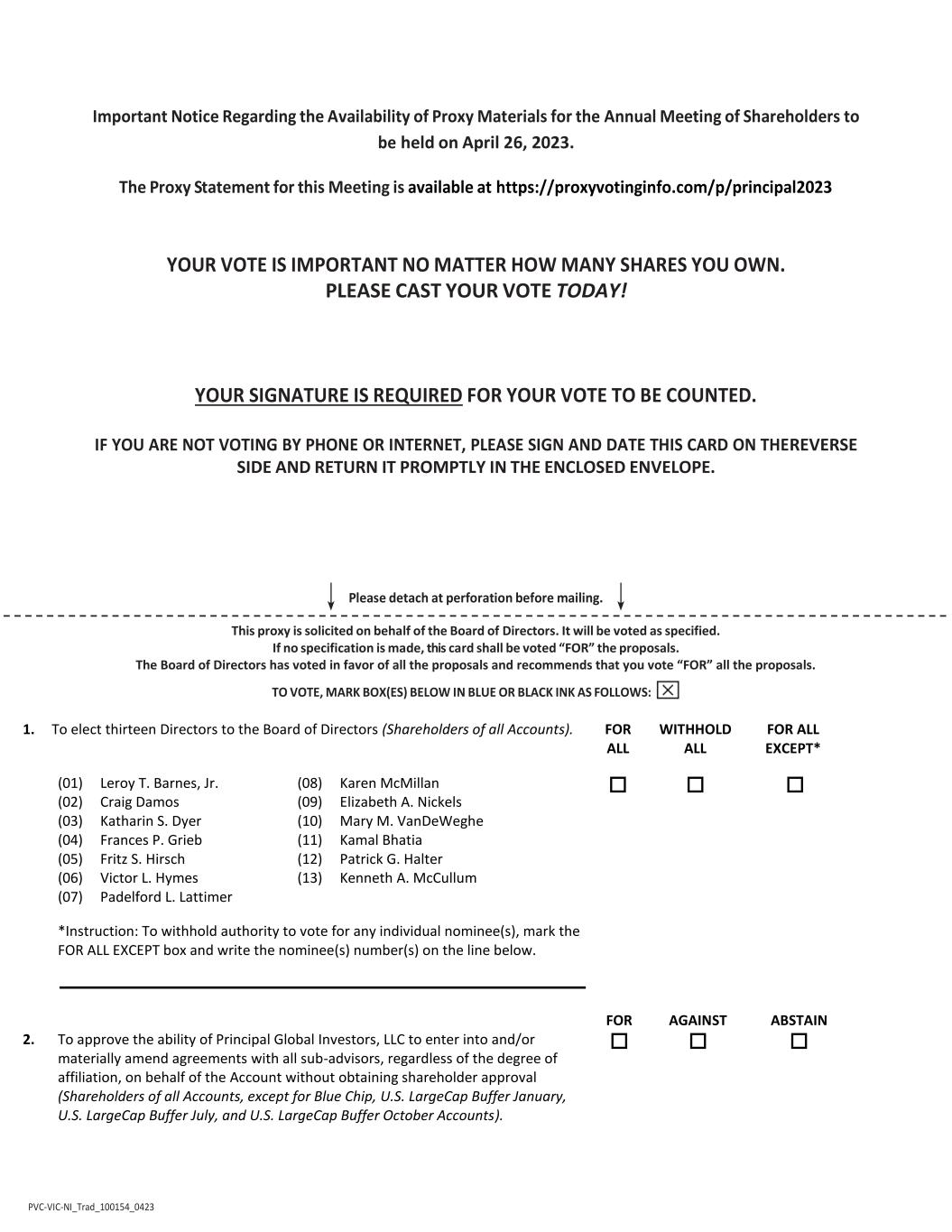

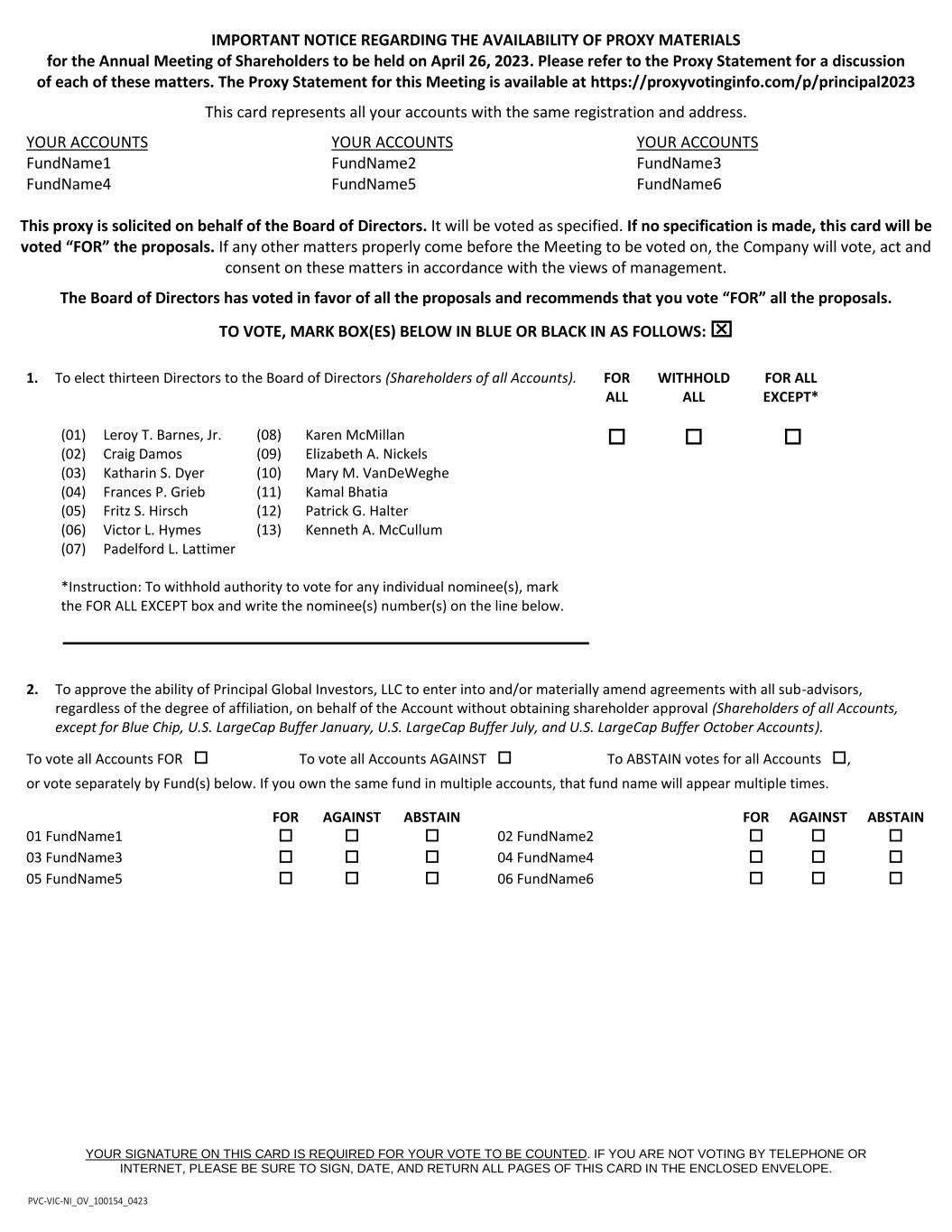

Proposal Affecting All Accounts. Shareholders of all Accounts are being asked to:

•Elect thirteen Directors as members of the Board of Directors.

Proposal Affecting Only Certain Accounts. Shareholders of all Accounts, except for Blue Chip, U.S. LargeCap Buffer January, U.S. LargeCap Buffer July, and U.S. LargeCap Buffer October Accounts, are being asked to:

•Approve the ability of Principal Global Investors, LLC to enter into and/or materially amend sub-advisory agreements with all sub-advisors, regardless of the degree of affiliation, as described in the proposal, on behalf of the Account without obtaining shareholder approval.

Enclosed you will find PVC’s Notice of SpecialJoint Annual Meeting of Shareholders, a Proxy Statement, explaining the matters to be voted on at the Meeting and a voting instruction card for shares of each FundAccount to which you ownedhad allocated contract value as of the close of business on the Record Date. The Proxy Statement provides background information and describes in detail the mattersproposals to be voted on at the Meeting.

The PVC Board of Directors has unanimously voted in favor of all the proposals and recommends that you give voting instructions “For” all the proposals.

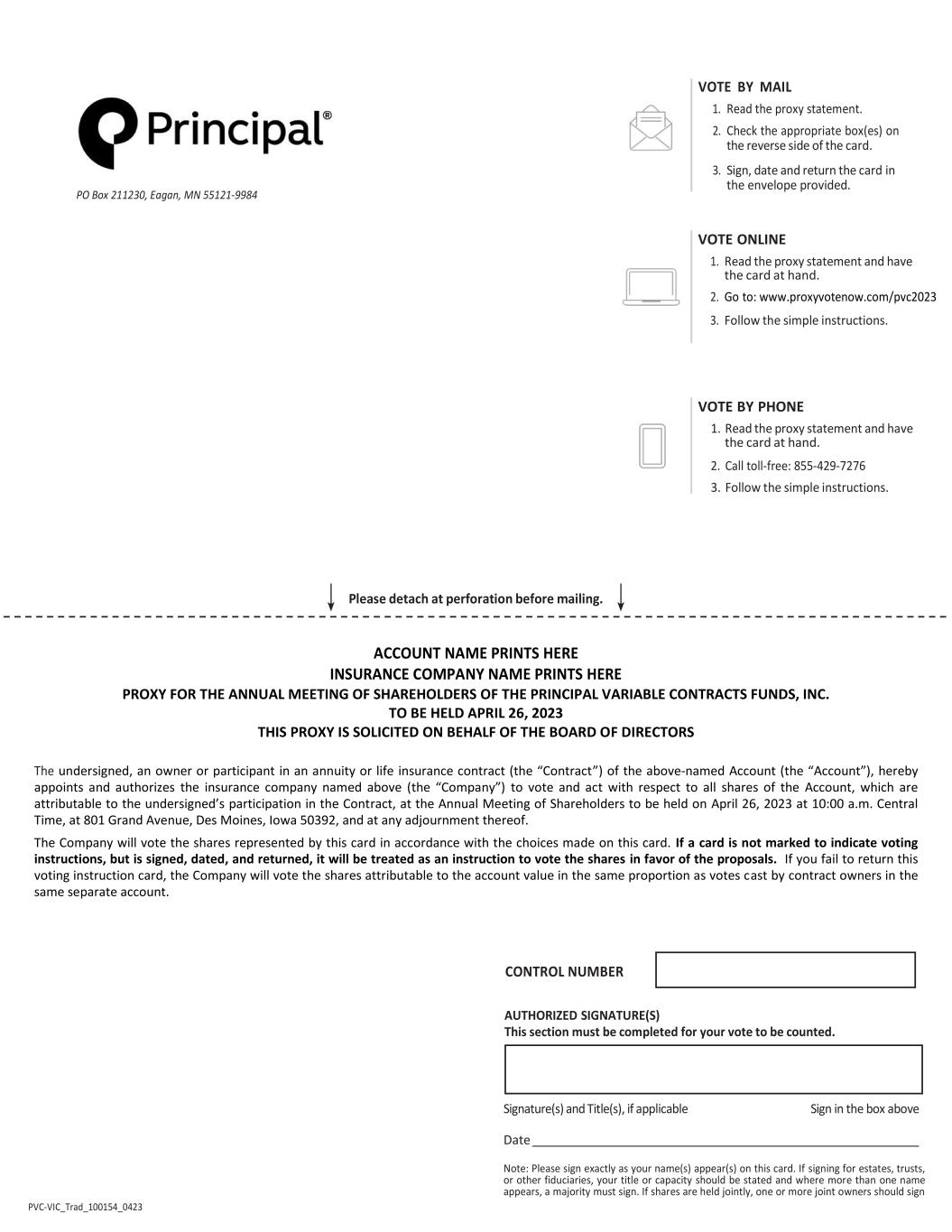

In order forFor your shares to be voted at the Meeting, we urge you to read the Proxy Statement and then complete and mail your voting instruction card(s) in the enclosed postage-paid envelope, allowing sufficient time for receipt by us by April 3, 2012.26, 2023. As a convenience, we offer three options by which toyou may give voting instructions:

By Internet: Follow the instructions located on your voting instruction card.card(s).

By Phone: The phone number is located on your voting instruction card.card(s). Be sure you have your control number, as printed on your voting instruction card,card(s), available at the timewhen you call.

By Mail: Sign your voting instruction cardcard(s) and enclose it in the postage-paid envelope provided in this proxy package.

We appreciate youryou taking the time to respond to this important matter. Your vote is important. If you have questions regarding the Meeting or these proxy materials, please call our shareholder services department toll-free at 1-855-600-4535. 1-833-290-2605.

| | | | | |

| Sincerely, |

| |

| /s/ NORA M. EVERETTKamal Bhatia |

| |

| Nora M. Everett |

| President and Chief Executive Officer |

2

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

650 8th711 High Street

Des Moines, Iowa 50392-208050392

NOTICE OF SPECIALJOINT ANNUAL MEETING OF SHAREHOLDERS

Asset Allocation | | | | | |

| Blue Chip Account | | Principal Capital AppreciationLifeTime Strategic Income Account |

BalancedBond Market Index Account | | Principal LifeTime 2010 Account |

Core Plus Bond & Mortgage Securities Account | | Principal LifeTime 2020 Account |

| Diversified Balanced Account | | Principal LifeTime 2030 Account |

Diversified GrowthBalanced Managed Volatility Account | | Principal LifeTime 2040 Account |

Diversified InternationalBalanced Volatility Control Account | | Principal LifeTime 2050 Account |

| Diversified Growth Account | Principal LifeTime 2060 Account |

| Diversified Growth Managed Volatility Account | Real Estate Securities Account |

| Diversified Growth Volatility Control Account | SAM Balanced Portfolio* |

| Diversified Income Account | SAM Conservative Balanced Portfolio* |

| Diversified International Account | SAM Conservative Growth Portfolio * |

| Equity Income Account | SAM Flexible Income Portfolio* |

| Global Emerging Markets Account | Principal LifeTimeSAM Strategic Income AccountGrowth Portfolio* |

| Government & High Quality Bond Account | | Real Estate Securities Account |

| Short-Term Income Account | | SAM Balanced Portfolio * |

International Emerging Markets Account | | SAM Conservative Balanced Portfolio* |

LargeCap Blend Account II | | SAM Conservative Growth Portfolio* |

LargeCap Growth Account | | SAM Flexible Income Portfolio* |

| LargeCap Growth Account I | | SAM Strategic Growth Portfolio *SmallCap Account |

| LargeCap S&P 500 Index Account | | Short-Term IncomeU.S. LargeCap Buffer January Account |

LargeCap ValueS&P 500 Managed Volatility Index Account | | SmallCap BlendU.S. LargeCap Buffer July Account |

MidCap Blend Account | | SmallCap GrowthU.S. LargeCap Buffer October Account II |

Money MarketPrincipal Capital Appreciation Account | | SmallCap Value Account I |

* Strategic Asset Management (SAM) PortfoliosPortfolio.

To the Shareholders:Shareholders and Contract Owners:

A joint annual meeting of shareholders of each of the series or funds (each a “Fund” and, collectively, the “Funds”) of Principal Variable Contracts Funds, Inc. (“PVC”("PVC"), Principal Funds, Inc., Principal Exchange-Traded Funds, and of Principal Diversified Select Real Asset Fund, will be held at 650 8th Street,801 Grand Avenue, Des Moines, Iowa 50392-208050392 on April 4, 2012,26, 2023 at 10:00 a.m. Central Time( (including any adjournments or postponements, the “Meeting”). TheFor PVC, the Meeting is being held to consider and vote on the following matters as well as any other issuesbusiness that may properly come before the Meeting and any adjournments:Meeting:

1.Election of the Board of Directors (All Shareholders of all Accounts);.

2. ApprovalApprove the ability of AmendedPrincipal Global Investors, LLC to enter into and/or materially amend sub-advisory agreements with all sub-advisors, regardless of the degree of affiliation, as described in the proposal, on behalf of the Fund without obtaining shareholder approval. (Shareholders of all Accounts, except for Blue Chip, U.S. LargeCap Buffer January, U.S. LargeCap Buffer July, and Restated Articles of Incorporation (All Shareholders);

3. Approval of Amendment or Elimination of Certain Fundamental Investment Restrictions:

| 3(a) | Approval of Amended Fundamental Restriction Relating to Senior Securities (All Funds).

|

| 3(b) | Approval of Amended Fundamental Restriction Relating to Commodities (All Funds).

|

| 3(c) | Approval of Amended Fundamental Restriction Relating to Real Estate (All Funds).

|

| 3(d) | Approval of Amended Fundamental Restriction Relating to Making Loans (All Funds).

|

| 3(e) | Approval of Amended Fundamental Restriction Relating to Diversification. |

(All Funds Except Real Estate Securities Account)U.S. LargeCap Buffer October Accounts).

A Proxy Statement providing information about the above proposals to be voted on at the Meeting is included with this Notice.

| 3(f) | Approval of Amended Fundamental Restriction Relating to Concentration |

(All Funds Except Real Estate Securities Account).

| 3(g) | Approval of Elimination of Fundamental Restriction Relating to Short Sales |

Each shareholder of record atas of the close of business on January 6, 2012,February 27, 2023, the record date for the Meeting, is entitled to notice of and to vote at the Meeting. The Accounts' shareholders of record are insurance company separate accounts that offer variable life and variable annuity contracts. If you are a Contract Owner, you are receiving these materials because you own a variable annuity contract or variable life insurance policy issued by an insurance company that is a shareholder of record, and you have allocated the contract value of such contract or policy to one or more Accounts. As a result, you have the right to instruct your insurance company how to vote the shares of the Accounts that represent your contract value.

Your vote is important. No matter how many shares you own, please vote. If you own shares inhave allocated your contract value to more than one Fund,Account, you may receive a separate voting instruction card for each such Account, and you need to return all of the proxy ballots.voting instruction cards (or follow the instructions to vote by telephone or by Internet). To save your Fund(s)Account(s) from incurring the cost of additional solicitations, please review the materials and vote today.

| | | | | |

| For the Board of Directors |

| |

| /s/ BETH C. WILSON |

| |

| Beth C. Wilson |

| Vice President and Secretary |

| |

| Dated: January 25, 2012March 6, 2023 |

Important Notice Regarding Availability of Proxy Statement for the Shareholders’Joint Annual Meeting of Shareholders to be Held on April 4, 2012.26, 2023. This Proxy Statement is available on the Internet at www.eproxy.com/principalva.

https://proxyvotinginfo.com/p/principal2023.

- 4 -

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 4, 2012

JANUARY 25, 2012

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

Introduction | | 7 |

| | |

Voting Information | 8 |

| |

| Proposal 1 | Election of the Board of Directors | |

| | |

| Proposal 2 | ApprovalApprove the ability of Amended and Restated ArticlesPrincipal Global Investors, LLC to enter into and/or materially amend sub-advisory agreements with all sub-advisors, regardless of Incorporationthe degree of affiliation, as defined in the proposal, on behalf of the Fund without obtaining shareholder approval | 20 |

| | |

Proposal 3 | Approval of Amendment or Elimination of Certain Fundamental

Investment Restrictions

| 23 |

| | |

3(a) | Approval of Amended Fundamental Restriction Relating to

Senior Securities

| 24 |

| | |

3(b) | Approval of Amended Fundamental Restriction Relating to

Commodities

| 25 |

| | |

3(c) | Approval of Amended Fundamental Restriction Relating to

Real Estate

| 26 |

| | |

3(d) | Approval of Amended Fundamental Restriction Relating to

Making Loans

| 27 |

| | |

3(e) | Approval of Amended Fundamental Restriction Relating to

Diversification | 28 |

| | |

3(f) | Approval of Amended Fundamental Restriction Relating to

Concentration

| 29 |

| | |

3(g) | Approval of Elimination of Fundamental Restriction Relating to

Short Sales

| 30 |

| | |

| Independent Registered Public Accounting Firm | 30 |

| |

Other Matters | | 33 |

| | |

| Appendix A | Outstanding Shares and Share Ownership | 35 |

| | |

| Appendix B | Audit Committee Charter | 55 |

| | |

Appendix C | Nominating and Governance Committee Charter | 60 |

| | |

Appendix D | Form of Amended and Restated Articles of Incorporation | 62 |

- 6 -

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

650 8th711 High Street

Des Moines, Iowa 50392-208050392

PROXY STATEMENT

SPECIALJOINT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 4, 201226. 2023

_________________INTRODUCTION

Each series of Principal Variable Contracts Funds, Inc. (“PVC” or “we”), Principal Funds, Inc. ("PFI"), Principal Exchange-Traded Funds ("PETF"), and Principal Diversified Select Real Asset Fund ("PDSRA"), will hold a special shareholders’joint annual meeting of shareholders on April 4, 201226, 2023 at 10:00 a.m. Central Time, at 650 8th Street,801 Grand Avenue, Des Moines, Iowa 50392-2080 (the50392 (including any adjournments or postponements, the “Meeting”). This Proxy Statement and the accompanying form of proxy ballotvoting instruction card(s) relate to PVC only and are first being sent to PVC shareholders on or about January 25, 2012.March 17, 2023. Separate proxy materials for each of PFI, PETF, and PDSRA are being sent to PFI, PETF, and PDSRA shareholders, respectively.

All sharesShares of each separate series or fund of PVC (each a “Fund”an “Account” and, collectively, the “Funds”“Accounts”) are owned of record by sub-accounts ofinsurance company separate accounts ("(“Separate Accounts") of insurance companies (each, an “Insurance Company”Accounts”) established to fund benefits under variable annuity contracts and variable life insurance policies (each a "Contract"“Contract”) issued by the Insurance Companies.such insurance companies (each an “Insurance Company”). Persons holding Contracts are referred to herein as "Contract“Contract Owners."”

PVC is a Maryland corporation and an open-end management investment company registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). PVC currently offers 34 Funds as set forth37 Accounts listed below:

Asset Allocation | | | | | |

| Blue Chip Account | | Principal Capital AppreciationLifeTime Strategic Income Account |

BalancedBond Market Index Account | | Principal LifeTime 2010 Account |

Core Plus Bond & Mortgage Securities Account | | Principal LifeTime 2020 Account |

| Diversified Balanced Account | | Principal LifeTime 2030 Account |

Diversified GrowthBalanced Managed Volatility Account | | Principal LifeTime 2040 Account |

Diversified InternationalBalanced Volatility Control Account | | Principal LifeTime 2050 Account |

| Diversified Growth Account | Principal LifeTime 2060 Account |

| Diversified Growth Managed Volatility Account | Real Estate Securities Account |

| Diversified Growth Volatility Control Account | SAM Balanced Portfolio* |

| Diversified Income Account | SAM Conservative Balanced Portfolio* |

| Diversified International Account | SAM Conservative Growth Portfolio * |

| Equity Income Account | SAM Flexible Income Portfolio* |

| Global Emerging Markets Account | Principal LifeTimeSAM Strategic Income AccountGrowth Portfolio* |

| Government & High Quality Bond Account | | Real Estate Securities Account |

| Short-Term Income Account | | SAM Balanced Portfolio * |

International Emerging Markets Account | | SAM Conservative Balanced Portfolio* |

LargeCap Blend Account II | | SAM Conservative Growth Portfolio* |

LargeCap Growth Account | | SAM Flexible Income Portfolio* |

| LargeCap Growth Account I | | SAM Strategic Growth Portfolio *SmallCap Account |

| LargeCap S&P 500 Index Account | | Short-Term IncomeU.S. LargeCap Buffer January Account |

LargeCap ValueS&P 500 Managed Volatility Index Account | | SmallCap BlendU.S. LargeCap Buffer July Account |

MidCap Blend Account | | SmallCap GrowthU.S. LargeCap Buffer October Account II |

Money MarketPrincipal Capital Appreciation Account | | SmallCap Value Account I |

* Strategic Asset Management (SAM) PortfoliosPortfolio.

The sponsor of PVCPrincipal Global Investors, LLC ("PGI") is Principal Life Insurance Company (“Principal Life”), and the investment advisor and fund administrator to the Funds is Principal Management Corporation (“PMC” or the “Manager”).Accounts. Principal Funds Distributor, Inc. (the “Distributor” or “PFD”(“PFD”) is the distributor for all share classes of the Funds. Principal Life, an insurance company organized in 1879 under the laws of Iowa, PMCAccounts. PGI and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. (“PFG”). TheirThe address is in care of the Principal Financial Group, 711 High Street, Des Moines, Iowa 50392-2080.50392.

PVC will furnish, without charge, a copycopies of its Annual Report to Shareholders for the fiscal year ended December 31, 2010most recent annual and Semi-Annual Report for the six-month period ended June 30, 2011semi-annual shareholder reports to any shareholder upon request. To obtain a copy of a report, please contact PVC by calling our shareholder services departmentthe Shareholder Services Department toll free at 1-800-222-5852 or by writing to PVC at the address above. PVC’s Annual Report for the fiscal year ended December 31, 2011 is expected toP.O. Box 219971, Kansas City, MO 64121-9971. Copies of each Account's most recent annual and semi-annual shareholder reports can also be sent to shareholders on or about February 23, 2012.obtained at www.PrincipalAM.com/Prospectuses.

Summary of ProposalsProposals.. The Meeting is being held to consider a number of matters.several proposals. The proposals to be voted upon, and the FundsAccounts to which each proposal applies, are set forth below.

| | | | | | | | | | | | | | |

| | Proposal | | Applicable FundsAccounts |

| Proposal 1 | | Election of the Board of Directors | All Shareholders |

| | Shareholders of all Accounts |

| Proposal 2 | Approval

| Approve the ability of AmendedPrincipal Global Investors, LLC to enter into and/or materially amend sub-advisory agreements with all sub-advisors, regardless of the degree of affiliation, as described in the proposal, on behalf of the Fund without obtaining shareholder approval. | | Shareholders of all Accounts, except for Blue Chip, U.S. LargeCap Buffer January, U.S. LargeCap Buffer July, and RestatedArticles of Incorporation

| All Shareholders

|

| | |

Proposal 3 | Approval of Amendment or Elimination of

Certain Fundamental Investment Restrictions

| |

| | |

3(a) | Approval of Amended Fundamental

Restriction Relating to Senior Securities

| All Funds |

| | |

3(b) | Approval of Amended Fundamental

Restriction Relating to Commodities

| All Funds |

| | |

3(c) | Approval of Amended Fundamental

Restriction Relating to Real Estate

| All Funds |

| | |

3(d) | Approval of Amended Fundamental

Restriction Relating to Making Loans

| All Funds |

| | |

3(e) | Approval of Amended Fundamental

Restriction Relating to Diversification

| All Funds Except Real Estate Securities Account |

| | |

3(f) | Approval of Amended Fundamental

Restriction Relating to Concentration

| All Funds Except Real Estate Securities Account |

| | |

3(g) | Approval of Elimination of Fundamental

Restriction Relating to Short Sales

| All FundsU.S. LargeCap Buffer October Accounts |

VOTING INFORMATION

Voting proceduresProcedures.. We are furnishing this This Proxy Statement to youis furnished in connection with the solicitation on behalf of proxies by the Board of proxiesDirectors (the "Board") of PVC. Please vote your shares by returning the enclosed card(s) in the enclosed postage-paid envelope or by following the instructions on the card(s) for voting by telephone or Internet. Shareholders who wish to be used atattend the Meeting. The Board is asking permission to vote for you. Meeting in person may call 1-833-290-2605 if they have any questions.

If you properly complete and return the enclosed voting instruction card(s) (or if you give your proxy ballot,by telephone or Internet), the persons named on the ballotcard(s) as proxies will vote your shares as you indicate on the ballotcard(s) (or as you instruct by telephone or forInternet) or "For" approval of each matterproposal for which there is no indication. If youYou may change your mind after you send in the ballot, you may change orvote and revoke your vote by: proxy at any time before it is voted at the Meeting in any of the following ways:

(i) by sending a written notice of revocation to the Meeting Secretary of Principal Variable Contracts Fund,Funds, Inc. atin care of the Principal Financial Group, 711 High Street, Des Moines, Iowa 50392-2080, prior50392;

(ii) by submitting another properly signed card at a later date to the Meeting; (ii) subsequent execution and returnMeeting Secretary of Principal Variable Contracts Funds, Inc. in care of the Principal Financial Group, 711 High Street, Des Moines, Iowa 50392;

(iii) by submitting another proxy ballot prior to the Meeting;by telephone or (iii)Internet at a later date; or

(iv) being present and voting in person at the Meeting after giving oral notice of the revocation to the ChairmanChair of the Meeting.

Please vote your shares by mailing the enclosed ballot in the enclosed postage paid envelope or by following the instructions on the ballot for voting by touch-tone telephone or via the Internet.

Voting rightsRights. . Only shareholders of record atas of the close of business on January 6, 2012February 27, 2023 (the "Record Date"“Record Date”) are entitled to vote.notice of and to vote at the Meeting. The shareholders of all FundsAccounts and all share classes will vote together on Proposal 1 regarding the election of Directors of PVC and Proposal 2 regarding approval of Amended and Restated Articles of Incorporation of PVC.Directors. The shareholders of each FundAccount, except for Blue Chip, U.S. LargeCap Buffer January, U.S. LargeCap Buffer July, and U.S. LargeCap Buffer October Accounts (none of which Accounts is voting on Proposal 2), will vote together as a single class and not by class of sharesseparate classes on each other proposal that we intend to submit to the shareholders of that Fund.Proposal 2. You are entitled to one vote on each proposal submitted to the shareholders of a Fundan Account for each share of the Fundthat Account you hold, and fractional votes for fractional shares held. Certain of the proposals require for approval the vote of a "majority of the outstanding voting securities," which is a term defined in the 1940 Act to mean, with respect to a Fund, the affirmative vote of the lesser of (1) 67% or more of the voting securities of the Fund present at the meeting of that Fund, if the holders of more than 50% of the outstanding voting securities of the Fund are present in person or by proxy, or (2) more than 50% of the outstanding voting securities of the Fund (a "Majority of the Outstanding Voting Securities"). Under this definition, a proposal could be approved by as little as approximately one-third of the outstanding voting securities of the Fund. The affirmative vote of the holders of a plurality of the shares voted at the Meeting is required for the election of aeach Director under Proposal 1. This means that those nominees for Director receiving the highest number of votes cast at the Meeting will be elected. The nominees are running unopposed, so each nominee is expected to be elected as a Director because all nominees who receive votes in favor will be elected. Proposal 2 requires for approval the affirmative vote of a “majority of the outstanding voting securities,” which is defined in the 1940 Act to mean, with respect to an Account, the affirmative vote of the lesser of (1) 67% or more of the voting securities of the Account present in person or by proxy at the meeting of that Account, if the holders of a majoritymore than 50% of the shares entitled to vote at the Meeting is required for the approvaloutstanding voting securities of the Amended and Restated ArticlesAccount are present in person or by proxy, or (2) more than 50% of Incorporation underthe

outstanding voting securities of the Account (such lesser amount being a “Majority of the Outstanding Voting Securities”). Under this definition, Proposal 2.2 could be approved by as little as approximately one-third of the outstanding voting securities of the Account to which that proposal applies.

The number of votes eligible to be cast at the Meeting with respect to each FundAccount as of the Record Date and other share ownership information are set forth in Appendix A to this Proxy Statement.

Quorum requirementsRequirements; Abstentions and Broker Non-Votes.. A quorum must be present at the Meeting for the transaction of business. Thebusiness by any Account. For Proposal 1, the presence in person or by proxy of one-third of the shares of PVC outstanding as of the close of business on the Record Date constitutes a quorum. For Proposal 2, the presence in person or by proxy of one-third of the shares of each Account (except for Blue Chip, U.S. LargeCap Buffer January, U.S. LargeCap Buffer July, and U.S. LargeCap Buffer October Accounts, none of the Fundswhich Accounts will vote on Proposal 2), outstanding at the close of business on the Record Date constitutes a quorum for a meeting of that Fund. For ProposalsAccount.

Abstentions, if any, will be considered present for purposes of determining the existence of a quorum but will be disregarded in determining the votes cast on a proposal. As a result, with respect to (i) Proposal 1 requiring the affirmative vote of a plurality of shares cast at the Meeting, abstentions will have no effect on the outcome of such proposal, and (ii) Proposal 2 requiring the presence in person or by proxyaffirmative vote of one-thirda Majority of the sharesOutstanding Voting Securities, as defined above, abstentions will have the effect of PVC outstanding ata vote against such proposals.

Broker non-votes, if any, will also be considered present for purposes of determining the closeexistence of business on the Record Date constitutes a quorum. AbstentionsPVC understands that, under the rules of the New York Stock Exchange, brokers and nominees may, for certain "routine" matters, grant certain discretionary authority to the proxies designated by the Board to vote without instructions from their customers if no instructions have been received prior to the date specified in the broker's or nominee's requests for voting instructions. A broker non-votes (proxiesnon-vote occurs when a broker or nominee indicates it has not received voting instructions from brokersa shareholder and is barred from voting the shares without such shareholder instructions because the proposal is considered non-routine under the rules of the New York Stock Exchange. Proposal 2 may be considered non-routine, so your broker or nominees indicating that they havenominee likely will not be permitted to vote your shares if it has not received instructions from you, resulting in broker non-votes. A broker non-vote on Proposal 2 will have the beneficial ownerssame effect as a vote against such proposal. Proposal 1 is considered routine under the rules of the New York Stock Exchange, so if you do not give your broker or nominee voting instructions on an item for which thethis proposal, your broker or nominee may vote your shares in its discretion, resulting in no broker non-votes. However, if your broker or nominee does not exercise such discretion and a broker non-vote results, such broker non-vote will have discretionary power) are counted toward a quorum but do not represent votes cast for any issue. Underno effect on the 1940 Act, the affirmative vote necessary to approve certainoutcome of the proposals may be determined with reference to a percentage of votes present at the meeting, which would have the effect of counting abstentions as if they were votes against a proposal.Proposal 1.

In the eventIf the necessary quorum to transact business or the vote required to approve a proposal is not obtained at the Meeting, the persons named as proxies or any shareholder present at the Meeting may propose one or more adjournments of the Meeting as to one or more proposals in accordance with applicable law to permit further solicitation of proxies. Any such adjournment as to a proposal or any other matter with respect to a Fundan Account will require the affirmative vote of the holders of a majority of the shares of the Fund castAccount present in person or by proxy at the Meeting. The persons named as proxies and any shareholder present at the Meeting will vote for or against any adjournment in their discretion.

Contract Owner voting instructionsVoting Instructions.. Shares of the FundsAccounts are sold to Separate Accounts of the Insurance Companies and are used to fund benefits under Contracts. Each Contract Owner whose Contract is funded by a Separate Account registered underhas the 1940 Act is entitledright to instruct the Contract Owner’s Insurance Company as to how to vote the shares attributable toof the Accounts that represent his or her Contract andcontract value. You can do so by marking voting instructions on the voting instruction cardcard(s) enclosed with this Proxy Statement and then signing and dating the voting instruction cardcard(s) and mailing the cardcard(s) in the envelope provided. If a card is not marked to indicate voting instructions, but is signed, dated, and returned, it will be treated as an instruction to vote the shares in favor of the proposals. Each Insurance Company will vote the shares for which it receives timely voting instructions from Contract Owners in accordance with those instructions andinstructions. Each Insurance Company will vote those shares for which it receives no timely voting instructions for and against approval of a proposal, or will abstain, in the same proportion as the shares for which it receivesdoes not receive timely voting instructions. Shares attributable to amounts invested by an Insurance Company will be votedinstructions from Contract Owners in the same proportion as votes cast by its Contract Owners. Accordingly, there are not expected to be any broker non-votes. As a resultBecause of the proportional voting as described above, it is unlikely that quorum requirements for the Meeting will not be satisfied, and, as a result, a small number of Contract Owners can determine the outcome of the voting.

Solicitation proceduresProcedures. . We intend PVC intends to solicit proxies by mail. Officers or employees of PVC, PMCPGI, or their affiliates may make additional solicitations by telephone, internet, facsimileInternet, or personal contact. They will not be specially compensated for these services. Brokerage houses, banks, and other fiduciaries may be requested to forward soliciting materials to their principalscustomers and to obtain authorization for the execution of proxies. For those services, PVC will reimburse them for their out-of-pocket expenses. PVC has retained the services of a professional

proxy soliciting firm, Boston Financial Data Services,DiCosta Partners, to assist in soliciting proxies and provide other services in connection therewith and estimates that the aggregate cost of such services will be approximately $255,387.$450,000.

Expenses of the MeetingMeeting. . The FundsAccounts will pay the expenses of the Meeting, including those associated with the preparation and distribution of proxy materials and the solicitation of proxies. The expenses will be allocated to the Account(s) generating the expense, based on the number of Contract Owners.

PROPOSAL 1

ELECTION OF THE BOARD OF DIRECTORS

(All Shareholders)Shareholders of all Accounts)

At its December 11-12, 2011its January 26, 2023 meeting, the Board increased the number of Directors from twelve to fourteen and named the fourteenthirteen persons listed below as nominees for election as Directors. ElevenUnless you do not authorize it, your proxy will be voted in favor of the fourteen nominees. Eleven of the nominees currently serve as Directors. TwoThe other nominees, Mr. Leroy T. Barnes, Jr.Kamal Bhatia and Mr. Tao Huang, were elected by the Board to begin serving as Directors effective at the Board meeting scheduled for March 2012. The final nominee, Mr. Michael J. Beer,Kenneth McCullum, each will become a Director effective at the Board meeting scheduled for June 2012immediately if he is elected as a Director at the Meeting. The increase inIf elected, Mr. Bhatia will fill the sizevacancy on the Board created by the departure of Timothy Dunbar, who will retire effective at the end of the Board is intended to permit the new Directors to have for a period of time the benefit of the continued service of two current Directors who, as described below and consistent with PVC’s retirement policy, will retire from the Board following its December 2012 meeting.Meeting.

Each nominee has agreed to be named in this Proxy Statement and to serve if elected. The Board has no reason to believe that any of the nominees will become unavailable for election as a Director. However, if that should occur before the Meeting, your proxy will be voted for the individualsindividual(s) recommended by the Board to fill the vacancies.each resulting vacancy.

The following table presents certain information regarding the currentPVC's Directors of PVC and the three new nominees, including their principal occupations which,(which, unless specific dates are shown, are of more than five years duration. In addition, the table includes information concerningduration) and other directorships each Director or nominee holdsheld in reporting companies under the Securities Exchange Act of 1934 or registered investment companies under the 1940 Act, as well as other companies.Act. Mr. Dunbar is not standing for re-election at the Meeting because he is retiring from the Board effective at the end of the Meeting. Information is listed separately for those Directors and nominees who are “interested persons” (as defined in the 1940 Act) of PVC (the “Interested Directors”) and those Directors and nominees who are not interested persons of PVC (the “Independent Directors”). ThreeFour of the nominees for Independent Director, Mr. Barnes,Hymes, Mr. DamosLattimer, Ms. Dryer and Mr. Huang,Ms. Grieb, have not previously been elected Directors by the shareholders of PVC.PVC's shareholders. The Board’s Nominating and Governance Committee, comprised entirelycomposed of four of PVC’s Independent Directors, selected and nominated Mr. Barnes,Hymes, Mr. DamosLattimer, Ms. Dryer and Mr. HuangMs. Grieb as candidates for Director upon the recommendations of one or more of the Independent Directors. Directors or with the assistance of a professional search firm. The two new nominees for Interested Director, Mr. Bhatia and Mr. McCullum, have not previously served as Directors, and both were selected and nominated as candidates for Director upon the recommendations of PGI, PFI's investment advisor.

All individuals who are current PVC Directors of PVC also serve as directorsDirectors of Principal Funds, Inc. (“PFI”),PFI, another mutual fund sponsoredadvised by Principal Life,PGI; as trustees of PETF, an exchange-traded fund advised by PGI; and allas trustees of PDSRA, an interval fund advised by PGI. All individuals who are nominees as PVC Directors of PVC are also currently standing as nominees for election as directors or trustees, as applicable, of PFI, PETF, and PDSRA and, if elected by itsthose respective shareholders, will serve as directors or trustees, as applicable, of PFI.PFI, PETF, and PDSRA. If the same individuals are not elected by the shareholders of botheach of PVC, PFI, PETF, and PFI,PDSRA the compositions of theirthose boards will differ. PVC, PFI, PETF, and PFIPDSRA (collectively, the “Fund Complex”) currently offer shares of a combined total of 97 portfolios or132 funds.

Each Director generally will serve until the next annual meeting of shareholders or until such Director’s earlier death, resignation, or removal. Independent Directors have a successor is72-year age limit and, for Independent Directors elected on or after September 14, 2021, a 72-year age limit or a 15-year term limit, whichever occurs first. The Board may waive the age or term limits in the Board’s discretion. Pursuant to this policy, Messrs. Barnes and qualified, except that, consistent with PVC’s retirement policy, Ms. Lukavsky and Mr. Gilbert will serve until the conclusion of the meeting of the BoardHirsch are expected to be heldretire in December 2012.2023.

Independent Directors and Nominees | | | | | | | | | | | | | | |

INDEPENDENT BOARD MEMBERS and NOMINEES |

| Name, Address,

and Year of Birth

| | Position(s)

Board Positions Held with PVC

Fund Complex | | Principal Occupation(s)

During the Past 5 Years

| Number of Portfolios Overseen in Fund Complex | Other Directorships

Held |

Elizabeth Ballantine

711 High Street

Des Moines, Iowa 50392

1948

| | Director (since 2004)

Member Nominating and Governance Committee

| | Principal, EBA Associates

(consulting and investments)

| | Durango Herald, Inc.;

McClatchy Newspapers, Inc.

|

| | | | | | During

Past 5 Years |

Leroy T. Barnes, Jr. 711 High Street Des Moines, IowaIA 50392 1951 | | Nominee for Director, | PFI and PVC (since 2012) Trustee, PETF (since 2014)

Trustee, PDSRA (since 2019) | Retired

| 132 | McClatchy Newspapers, Inc.; Herbalife Ltd. (2000 - 2020); Frontier Communications, Inc.; Longs Drug Stores |

Independent Directors and Nominees |

Name, Address

and Year of Birth

| | Position(s)

Held with PVC

| | Principal Occupation(s)

During the Past 5 Years

| | Other

Directorships Held

|

Kristianne Blake

711 High Street

Des Moines, Iowa 50392

1954

| | Director (since 2006)

Member Operations Committee

| | President, Kristianne Gates Blake, P.S. (personal financial and tax planning) | | Avista Corporation (energy); Russell Investment Company,* Russell Investment Funds*

(48 portfolios overseen) |

| | | | | | 2005 - 2019) |

Craig Damos 711 High Street Des Moines, IowaIA 50392 1954 | | Lead Independent Board Member (since 2020) Director, PFI and PVC (since 2008) Trustee, PETF (since 2014) Member Operations CommitteeTrustee, PDSRA (since 2019)

| | President, TheC.P. Damos CompanyConsulting LLC (consulting services). Formerly Chairman/CEO/ President and Vertical Growth Officer, The Weitz Company (general construction) | | Hardin Construction Company |

| | | | | | |

Richard W. Gilbert

711 High Street

Des Moines, Iowa 50392

1940

| | Director (since 2000)

Member Audit Committee

| | President, Gilbert Communications, Inc. (business consulting) | | Calamos Asset

Management, Inc.

|

| | | | | | |

Mark A. Grimmett

711 High Street

Des Moines, Iowa 50392

1960

| | Director (since 2004)

Member Executive Committee and Nominating and Governance Committee

| | Executive Vice President and CFO, Merle Norman Cosmetics, Inc. (cosmetics manufacturing) | 132 | None |

Katharin S. Dyer

711 High Street

Des Moines, IA 50392

1957 | Director, PFI and PVC (since 2023) Trustee, PETF and PDSRA (since 2023 | Founder and Chief Executive Officer, Pivotwise (consulting services)

Global Partner, IBM (technology company) from 2016-2018 | 132 | Liquidity Services, Inc. (2020 - present) |

Frances P. Grieb

711 High Street

Des Moines, IA 50392

1960 | Director, PFI and PVC (since 2023) Trustee, PETF and PDSRA (since 2023 | Retired | 132 | First Interstate BancSystems, Inc. (2022 - present)

Great Western Bancorp, Inc. and Great Western Bank (2014 - 2022) |

Fritz S. Hirsch 711 High Street Des Moines, IowaIA 50392 1951 | | Director, PFI and PVC (since 2005) Trustee, PETF (since 2014) Member Audit CommitteeTrustee, PDSRA (since 2019)

| | Interim CEO, MAM USA (manufacturer of infant and juvenile products). Formerly President, Sassy, Inc. (manufacturer of infant and juvenile products) February 2020 to October 2020, | 132 | Focus Products Group (housewares) |

| | | | | | MAM USA (2011 - present) |

Tao HuangVictor L. Hymes

711 High Street Des Moines, IowaIA 50392 19621957

| Director, PFI and PVC (since 2020) Trustee, PDSRA and PETF (since 2020)

| Nominee for DirectorFounder, CEO, and Chief Investment Officer, Legato Capital Management, LLC (investment management company) | 132 | Formerly, Chief Operating Officer, Morningstar, Inc. (investment research) | | Armstrong World Industries, Inc. (manufacturing) |

| | | | | | None |

William C. KimballPadelford L. Lattimer

711 High Street Des Moines, IowaIA 50392 19471961

| | Director, PFI and PVC (since 2000)2020) Trustee, PDSRA and PETF (since 2020) Member Nominating and Governance Committee

| Managing Partner, TBA Management Consulting LLC (management consulting and staffing company) | Partner, Kimball – Porter Investments L.L.C.

| | Casey's General Stores, Inc. |

| | | | | | |

Barbara A. Lukavsky

711 High Street

Des Moines, Iowa 50392

1940

| | Director (since 1993)

Member Operations Committee

| | President and CEO, Barbican Enterprises, Inc. (cosmetics manufacturing) | 132 | None |

| | | | | | |

Daniel Pavelich

Karen McMillan

711 High Street

Des Moines, IowaIA 50392

1944

1961 | Director, PFI and PVC (since 2014) Trustee, PETF (since 2014)

Trustee, PDSRA (since 2019) | Founder/Owner, Tyche Consulting LLC (consulting services)

Managing Director, Patomak Global Partners, LLC

(financial services consulting) from 2014-2021 | 132 | None |

Elizabeth A. Nickels

711 High Street

Des Moines, IA 50392

1962 | Director, PFI and PVC (since 2006)Member Audit Committee

| 2015) Trustee, PETF (since 2015)

Trustee, PDSRA (since 2019) | Retired | 132 | Catalytic,SpartanNash (2000 - 2022)

|

Mary M. VanDeWeghe

711 High Street

Des Moines, IA 50392

1959 | Director, PFI and PVC (since 2018) Trustee, PETF (since 2018)

Trustee, PDSRA (since 2019) | CEO and President, Forte Consulting, Inc. (offshore software development)(financial and management consulting) | 132 | Helmerich & Payne (2019 - present);

Denbury Resources Inc. ( 2019 - 2020) |

The following Directors are considered to be Interested Directors because they are affiliated persons of PGI, PFD, which currently serves as PVC's principal underwriter, or Principal Securities, Inc. ("PSI”), PVC's former principal underwriter.

* | PVC and the funds of Russell Investment Funds and Russell Investment Company have one or more common sub-advisors. |

Interested Directors | | | | | | | | | | | | |

INTERESTED BOARD MEMBERS and NOMINEES |

| Name, Address,

and Year of Birth

| | Position(s)

Board Positions Held with Fund Complex | | Positions with the ManagerPGI and its affiliates; Principal Occupation(s) During Past 5 Years** (unless noted otherwise) | Number of

Portfolios

Overseen

in Fund

Complex | Other Directorships Held During

Past 5 Years |

| | | | | | |

Michael J. Beer

Kamal Bhatia

711 High Street

Des Moines, IowaIA 50392

1961

1972 | President and Chief Executive Officer (since 2019) | Nominee for DirectorPGI

Director (since 2019) President-Principal Funds (since 2019) PFD Director (since 2019) PFGI, PFSI, and PLIC Senior Executive Director and Chief Operating Officer - PAM (since 2022) Senior Executive Director and Chief Operating Officer - PGI (2020-2022) President-Principal Funds (2019-2020) Post Director (since 2020) Principal-REI Senior Executive Director and Chief Operating Officer - PGI (since 2022) Director (since 2020) PSS Executive Vice President (since 2019) (since 2001)Director and Chair (2019-2022)

Spectrum Director (since 2021) Origin Additional Director (since 2022) Oppenheimer Funds Senior Vice President (2011-2019) | 132 | None |

Patrick G. Halter

711 High Street

Des Moines, IA 50392

1959 | Director, PFI and PVC (since 2017) Trustee, PETF (since 2017)

Trustee, PDSRA (since 2019) | PGI Chair (since 2018) Chief Executive Officer and President (since 2018) Director (since 2003) PFGI, PFSI, and PLIC President and Chief Executive Officer - PAM (since 2022) President - PGAM (2020-2022) Post Director (since 2017) Chair (2017-2020) Principal-REI President - PGAM (since 2022) Director and Chair (since 2004) Chief Executive Officer and President (2018-2021) Origin Director (2018-2019) | 132 | None |

Kenneth A. McCullum

711 High Street

Des Moines, IA 50392

1964 | | PFSI Executive Vice President and Chief OperatingRisk Officer PMC. (since 2023) Senior Vice President and Chief Risk Officer (2020-2023) Vice President and Chief Actuary (2015-2020) PLIC Executive Vice President PFDand Chief Risk Officer (since 2006). President, Princor, PSS (since 2007). Director, PMC (since 2006), Princor, and PSS (since 2007). Vice President – Mutual Funds and Broker Dealer, PLIC. | | None |

| | | | | | |

Ralph C. Eucher2023)

711 High Street

Des Moines,

Iowa 50392

1952

| | Chairman, Director (since 1999), Member Executive Committee | | Director, PMC (since 2008), PSS (since 2008), CCI (since 2009) and Spectrum. Chairman, PFD (2006-2008). Senior Vice President PLIC. | | None |

| | | | | | |

Nora M. Everettand Chief Risk Officer (2020-2023)

711 High Street

Des Moines,

Iowa 50392

1959

| | Chief Executive Officer

President, Director (since 2008), Member Executive

Committee

| | Vice President and Director, PMC (since 2008). Director, PFD (since 2008), Princor (since 2008), PSS (since 2008), and Edge (since 2008). Chief Executive Officer, Princor (since 2009). Senior Vice President/Retirement & Investors Services, PLIC.Actuary (2015-2020) | 132 | None |

| | | | | |

** | Abbreviations used in this table:: | |

| · | Columbus Circle Investors (CCI) |

| · | EdgeOrigin Asset Management Inc. (Edge) |

| · | Princor Financial Services Corporation (Princor) |

| · | Principal Funds Distributor, Inc. (PFD) |

| ·LLP (Origin) | Principal Global Investors, LLC (PGI) |

| ·Post Advisory Group, LLC (Post) | Principal Life Insurance Company (PLIC) |

| · | Principal Asset Management Corporation (PMC) |

| ·(PAM) | Principal Real Estate Investors, LLC (PREI)(Principal - REI) |

| Principal Financial Group, Inc. (PFGI) | ·Principal Securities, Inc. (PSI) |

| Principal Financial Services, Inc. (PFSI) | Principal Shareholder Services, Inc. (PSS) |

| ·Principal Funds Distributor, Inc. (PFD) | Spectrum Asset Management, Inc. (Spectrum) |

| Principal Global Asset Management (PGAM) | |

During the last fiscal year ended December 31, 2011, the Board of Directors held eight meetings. For that fiscal year, each current Director attended at least 75% of the aggregate number of meetings of the Board and of any Board Committees on which the Director served, held during the time the Director was a member of the Board.

Correspondence intended for the Board or for an individual Director may be sent to the attention of the Board or the individual Director at 650 8th711 High Street, Des Moines, Iowa 50392-2080.50392. All communications addressed to the Board or to an individual Director received by PVC are forwarded to the full Board or to the individual Director.

Officers of PVC

The following table presents certain information regarding the current officers of PVC, including their principal occupations which,(which, unless specific dates are shown, are of more than five years duration.duration). Officers serve at the pleasure of the Board of Directors.Board. Each of the officers of PVC officer holds the same position with PFI.

PFI, PETF, and PDSRA.

| | | | | | | | |

| FUND COMPLEX OFFICERS |

Name, Address and Year of Birth | | Officers Position(s) Held

Held with PVCFund Complex

| | Positions with PGI and its Affiliates; Principal Occupation(s) Occupations During the Past 5 Years **Years** |

Michael J. Beer

Kamal Bhatia

711 High Street

Des Moines, IowaIA 50392

1961

1972 | President and Chief Executive Officer

(since 2019) | PGI Director (since 2019) President-Principal Funds (since 2019) PFD Director (since 2019) PFGI, PFSI, and PLIC Senior Executive Vice President (since 2001)

| | Executive Vice PresidentDirector and Chief Operating Officer PMC. - PAM (since 2022)Senior Executive Director and Chief Operating Officer - PGI (2020-2022) President-Principal Funds (2019-2020) Post Director (since 2020) Principal-REI Senior Executive Director and Chief Operating Officer - PGI (since 2022) Director (since 2020) PSS Executive Vice President PFD (since 2006). President, Princor, PSS2019) Director and Chair (2019-2022) Spectrum Director (since 2007).2021) Origin Additional Director PMC (since 2006), Princor, and PSS (since 2007).2022) Oppenheimer Funds Senior Vice President – Mutual Funds and Broker Dealer, PLIC.(2011-2019) |

| | | | |

Randy L. Bergstrom D. Bolin

711 High Street

Des Moines, IowaIA 50392

1955

1961 | | Assistant Tax Counsel (since 2005)

(since 2020) | | Vice President/Associate General Counsel, PGI (since 2006) and PLIC. |

2016)

Name, Address and Year of Birth | | Officers Position(s)Vice President/Associate General Counsel, PFSI (since 2013)

Held with PVC

| | Principal Occupation(s)

During the Past 5 Years **Vice President/Associate General Counsel, PLIC (since 2013)

|

David J. Brown

711 High Street

Des Moines, Iowa 50392

1960

| | Chief Compliance Officer

(since 2004)

| | Senior Vice President, PMC, PFD (since 2006), Princor, and PSS (since 2007). Vice President/Compliance, PLIC. |

| | | | |

Jill R. Brown

1100 Investment Boulevard, Ste 200

El Dorado Hills, CA 95762

1967

| | Senior Vice President

(since 2007)

| | Senior Vice President, PMC, Princor, and PSS (since 2007). President, PFD (since 2010). Prior thereto, Senior Vice President and Chief Financial Officer, PFD (2006-2010). |

| | | | |

Teresa M. Button

711 High Street

Des Moines, Iowa 50392

1963

| | Treasurer

(since 2011)

| | Treasurer (since 2011) for PMC, Princor, PSS, and Spectrum. Vice President and Treasurer since 2011 for PFD, PGI, PREI and Edge. Vice President and Treasurer, PLIC. |

| | | | |

Cary Fuchs

1100 Investment Boulevard, Ste 200

El Dorado Hills, CA 95762

1957

| | Senior Vice President of Distribution (since 2007) | | Chief Operating Officer, PFD (since 2010). President, PFD (2007-2010). Senior Vice President/Mutual Fund Operations, PSS (since 2009). Vice President/Mutual Fund Operations, PSS (2007-2009). Director – Transfer Agent & Administrative Services, PLIC. Prior thereto, First Vice President, WM Shareholder Services and WM Funds Distributor, Inc. |

| | | | |

Stephen G. Gallaher

711 High Street

Des Moines, Iowa 50392

1955

| | Assistant Counsel

(since 2006)

| | Assistant General Counsel, PMC (since 2007), PFD (since 2007), Princor (since 2007), PSS (since 2007), and PLIC. Prior thereto, Second Vice President and Counsel.

|

| | | | |

Ernest H. Gillum

711 High Street

Des Moines, Iowa 50392

1955

| | Vice President (since 2000)

Assistant Secretary

(since 1993)

| | Vice President and Chief Compliance Officer, PMC. Vice President, Princor, and PSS (since 2007). |

| | | | |

Patrick A. Kirchner

711 High Street

Des Moines, Iowa 50392

1960

| | Assistant Counsel

(since 2002)

| | Assistant General Counsel, PMC (since 2008), Princor (since 2008), and PGI (since 2008) and PLIC. |

| | | | |

Carolyn F. Kolks

711 High Street

Des Moines, Iowa 50392

1962

| | Assistant Tax Counsel

(since 2005)

| | Counsel, PGI and PLIC. |

| | | | |

Jennifer A. MillsBeth Graff

711 High Street Des Moines, IA 50392 19731968

| | Vice President and Assistant CounselController (since 2010)2021)

| Director – Fund Accounting, PLIC (since 2016)

|

Gina L. Graham

711 High Street

Des Moines, IA 50392

1965 | Counsel, PMCTreasurer (since 2009),2016) | Vice President and Treasurer, PGI (since 2016)

Vice President and Treasurer, PFD (since 2009), Princor2016)

Vice President and Treasurer, PFSI (since 2009),2016)

Vice President and Treasurer, PLIC (since 2016)

Vice President and Treasurer, Principal - REI (since 2017)

Vice President and Treasurer, PSI (since 2016)

Vice President and Treasurer, PSS (since 2009),2016)

Vice President and PLICTreasurer, RobustWealth, Inc. (since 2006).2018) |

| | | | | | | | |

| | | | FUND COMPLEX OFFICERS |

Layne A. RasmussenName, Address

and Year of Birth | Position(s) Held with Fund Complex | Positions with PGI and its Affiliates; Principal Occupations During Past 5 Years** |

Megan Hoffmann 711 High Street Des Moines, IowaIA 50392 19581979

| | Chief Financial Officer (since 2008), Vice President (since 2005)

Controller (since 2000)

| | Vice President and Controller (since 2021) | Director – Mutual Funds, PMC.Accounting, PLIC (since 2020) Assistant Director – Accounting, PLIC (2017-2020)

|

Laura B. Latham

711 High Street

Des Moines, IA 50392

1986 | Assistant Counsel and Assistant Secretary

(since 2018) | Counsel, PGI (since 2018)

Counsel, PLIC (since 2018)

|

Diane K. Nelson

711 High Street

Des Moines, IA 50392

1965 | AML Officer (since 2016) | Chief Compliance Officer/AML Officer, PSS (since 2015) |

Michael D. RoughtonTara Parks

711 High Street Des Moines, IowaIA 50392 19511983

| | Counsel

(since 1990)

| | Senior Vice President and Associate GeneralAssistant Controller(since 2021) | Director – Accounting, PLIC (since 2019) Tax Manager – ALPS Fund Services (2011 – 2019) |

Deanna Y. Pellack

711 High Street

Des Moines, IA 50392

1987 | Assistant Counsel PMC and Princor. Senior Assistant Secretary (since 2022) | Counsel, PLIC (since 2022) Vice President, The Northern Trust Company (2019-2022) Second Vice President, The Northern Trust Company (2014-2019) Secretary, Advisers Investment Trust (2021-2022) Assistant Secretary, Advisers Investment Trust (2018-2021) |

Sara L. Reece

711 High Street

Des Moines, IA 50392

1975 | Vice President and Counsel, PFDChief Operating Officer (since 2006), PSS (since 2007). 2021) Vice President and Associate General Counsel, PGI and PLIC.Controller (2016-2021) | Managing Director – Global Fund Ops, PLIC (since 2021) Managing Director – Financial Analysis/ Planning, PLIC (2021) Director – Accounting, PLIC (2015-2021) |

Teri R. Root

711 High Street

Des Moines, IA 50392

1979 | Chief Compliance Officer (since 2018)

Interim Chief Compliance Officer (2018)

Deputy Chief Compliance Officer

(2015-2018) | | | Chief Compliance Officer - Funds, PGI (since 2018)

Vice President, PSS (since 2015) |

Adam U. Shaikh

711 High Street

| | Assistant Counsel

(since 2006)

| | Counsel, PMC (since 2007), PFD (since 2007), Princor (since 2007), PSS (since 2007) and |

Name, Address and Year of Birth | | Officers Position(s)

Held with PVC

| | Principal Occupation(s)

During the Past 5 Years **

|

Des Moines, Iowa 50392

1972

| | | | PLIC (since 2006). |

| | | | |

Dan L. WestholmMichael Scholten

711 High Street Des Moines, IowaIA 50392 19661979

| Chief Financial Officer (since 2021) | Chief Operations Officer, PFD (since 2022) Chief Financial Officer, PFD (2016-2022) Assistant TreasurerVice President and Actuary, PLIC (since 2021) (since 2006)

| | DirectorChief Financial Officer – Treasury, PMC, Princor (2008-2009),Funds/Platforms, PLIC (since 2015)Chief Financial Officer, PSS (since 2007), and PLIC.2015) |

Adam U. Shaikh

711 High Street

Des Moines, IA 50392

1972 | Assistant Secretary (since 2022)

Assistant Counsel (since 2006) | | | Assistant General Counsel, PGI (since 2018)

Counsel, PLIC (since 2006) |

John L. Sullivan

711 High Street

Des Moines, IA 50392

1970 | Assistant Counsel and Assistant Secretary

(since 2019) | Counsel, PGI (since 2020)

Counsel, PLIC (since 2019)

Prior thereto, Attorney in Private Practice |

Dan L. Westholm

711 High Street

Des Moines, IA 50392

1966 | Assistant Treasurer (since 2006) | Assistant Vice President-Treasury, PGI (since 2013)

Assistant Vice President-Treasury, PFD (since 2013)

Assistant Vice President-Treasury, PLIC (since 2014)

Assistant Vice President-Treasury, PSI (since 2013)

Assistant Vice President-Treasury, PSS (since 2013) |

| Beth C. Wilson

711 High Street

Des Moines, IowaIA 50392

1956

| | Vice President and Secretary (since 2007) | | Vice President, PMCDirector and Secretary-Funds, PLIC (since 2007) and Princor (2007-2009). Prior thereto, Segment Business Manager for Pella Corp. |

** | Abbreviations used in this table: | | | | | | | |

| FUND COMPLEX OFFICERS |

Name, Address and Year of Birth | Position(s) Held with Fund Complex | Positions with PGI and its Affiliates; Principal Occupations During Past 5 Years** |

Clint L. Woods

711 High Street

Des Moines, IA 50392

1961 | Counsel, Vice President, and

Assistant Secretary (since 2018)

Of Counsel (2015-2018)

| PGI Vice President, Associate General Counsel, and Assistant Secretary (since 2021) Vice President, Associate General Counsel, and Secretary (2020-2021) Vice President, Associate General Counsel, Governance Officer, and Assistant Corporate Secretary (2018-2020) PFD Vice President, Associate General Counsel, and Secretary (since 2021) Vice President, Associate General Counsel, and Assistant Corporate Secretary (2019-2021) PFSI Vice President, Associate Counsel, Governance Officer, and Assistant Corporate Secretary (since 2015) PLIC Vice President, Associate General Counsel, Governance Officer, and Assistant Corporate Secretary (since 2015) Post Assistant Secretary (since 2021) Secretary (2020-2021) Principal-REI Vice President, Associate General Counsel, Governance Officer, and Secretary (since 2020) Vice President, Associate Counsel, Governance Officer, and Assistant Corporate Secretary (2020) PSI Vice President, Associate General Counsel, and Secretary (2021-2022) Vice President, Associate General Counsel, and Assistant Corporate Secretary (2019-2021) PSS Vice President, Associate General Counsel, and Secretary (since 2021) Vice President, Associate General Counsel, and Assistant Corporate Secretary (2019-2021) RobustWealth, Inc. Vice President, Associate General Counsel, and Assistant Corporate Secretary (since 2019) Spectrum Assistant Secretary (since 2021) Secretary (2020-2021) |

Jared A. Yepsen

711 High Street

Des Moines, IA 50392

1981 | Assistant Tax Counsel (since 2017) | Counsel, PGI (2017-2019)

Counsel, PLIC (since 2015) |

| · | Columbus Circle Investors (CCI) | | | |

**Abbreviations used: | · |

EdgeOrigin Asset Management Inc. (Edge) |

| · | Princor Financial Services Corporation (Princor) |

| · | Principal Funds Distributor, Inc. (PFD) |

| ·LLP (Origin) | Principal Global Investors, LLC (PGI) |

| ·Post Advisory Group, LLC (Post) | Principal Life Insurance Company (PLIC) |

| · | Principal Asset Management Corporation (PMC) |

| ·(PAM) | Principal Real Estate Investors, LLC (PREI)(Principal - REI) |

| Principal Financial Group, Inc. (PFGI) | ·Principal Securities, Inc. (PSI) |

| Principal Financial Services, Inc. (PFSI) | Principal Shareholder Services, Inc. (PSS) |

| ·Principal Funds Distributor, Inc. (PFD) | Spectrum Asset Management, Inc. (Spectrum) |

| Principal Global Asset Management (PGAM) | |

Leadership Structure of the Board of Directors

Overall responsibility for directing the business and affairs of PVC rests with the Board of Directors, who are elected by PVC's shareholders. In addition to serving on the Board of PVC, each Director serves on the Board of PFI. The Board is responsible for overseeing thePVC's operations of PVC in accordance with the provisions of the 1940 Act, other applicable laws, and PVC’sPVC's charter. In addition to serving on the PVC Board, each Director serves on the PFI Board, the PETF Board, and the PDSRA Board. The Board elects the officers of PVC to supervise its day-to-day operations. The Board meets in regularly scheduled meetings eight times throughout the year. Board meetings may occur in-person, by telephone, or by telephone.virtually. In addition, the Board holds special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regularregularly scheduled meetings. Board members who are Independent Directors also meet annually to consider renewal of PVC'sPVC’s advisory contracts. The

As of the Record Date, the Board is currently composed of eleventwelve members, nineten of whom are Independent Directors. As stated above, Mr. Dunbar has announced his intention to retire as member of the Board effective at the end of the Meeting. Mr. Bhatia will fill the Board vacancy created by Mr. Dunbar's retirement, effective immediately, if he is elected a Director at the Meeting. Following Mr. Dunbar's retirement and if all nominees are elected, the Board will be composed of thirteen members, ten of whom are Independent Directors.

Currently, the Chair of the Board, Timothy M. Dunbar is an interested person of PVC. The Independent Directors have appointed a lead Independent Director, currently Mr. Damos, whose role is to review and approve, with the Chair, each Board meeting's agenda and to facilitate communication between and among the Independent Directors, management, and the full Board. The Board’s leadership structure is appropriate for the Fund Complex given the characteristics and circumstances, including the number of portfolios, variety of asset classes, the net assets, and distribution arrangements. The appropriateness of this structure is enhanced by the establishment and allocation of responsibilities among the Board committees, which are described below and which report their activities to the Board on a regular basis. Following Mr. Dunbar's retirement at the end of the Meeting, the Board anticipates continuing its current governance structure with an interested Board Chair and a lead Independent Director.

Each Director and Director nominee has significant prior senior management and/or board experience. As stated above, in December the Board set the number of Directors at fourteen and appointed two of three new nominees as Directors. The appointment of the two new nominees for Director, Mr. Barnes and Mr. Huang, will become effective at the Board meeting scheduled for March 2012. Mr. Beer, the third new nominee, will become a Director effective at the Board meeting scheduled for June 2012, if he is elected as a Director at the Meeting.

The Chairman of the Board is an interested person of PVC. The Independent Directors of PVC have appointed a lead Independent Director whose role is to review and approve, with the Chairman, the agenda for each Board meeting and facilitate communication among PVC's Independent Directors as well as communication between the Independent Directors, management of PVC and the full Board. PVC has determined that the Board's leadership structure is appropriate given the characteristics and circumstances of PVC, including such items as the number of series or portfolios that comprise PVC, the variety of asset classes those series reflect, the net assets of PVC, the committee structure of the Board and the distribution arrangements of PVC. The appropriateness of this structure is enhanced by PVC’s Board Committees, which are described below, and the allocation of responsibilities among them.

The Directors were selected to serve, and continue to serve, on the Board based upon their skills, experience, judgment, analytical ability, diligence, and ability to work effectively with other Board members, a commitment to the interests of shareholders, and, for each Independent Director, a demonstrated willingness to take an independent and questioning view of management. In addition to these general qualifications, the Board seeks members who will build upon the diversity of the Board. In addition to those qualifications, the followingBoard's diversity. Below is a brief discussion of

the specific education, experience, qualifications, or skills that led to the conclusion that each person identified below should serve as a Director for PVC.Director. As required by rules the SEC has adopted under the 1940 Act, PVC'sthe Independent Directors select and nominate all candidates for Independent Director positions.

Independent Directors

Board Members

Leroy T. Barnes, Jr.Elizabeth Ballantine. Ms. Ballantine Mr. Barnes has served as a Directoran Independent Board Member of PVC and PFIthe Fund Complex since 2004. Through her professional training and experience as an attorney and her experience as a director of Principal Funds, investment consultant and a director, Ms. Ballantine is experienced in financial, investment and regulatory matters.

Leroy T. Barnes. Mr. Barnes will begin serving as a director of PFI and PVC in March 2012. From 2001-2005,2001 to 2005, Mr. Barnes served as Vice President and Treasurer of PG&E Corporation. From 1997-2001,1997 to 2001, Mr. Barnes served as Vice President and Treasurer of Gap, Inc. Through his education, and employment experience, and experience as a director,board member, Mr. Barnes is experienced with financial, accounting, regulatory and investment matters.

Kristianne Blake. Ms. Blake has served as a Director of PVC and PFI since 2007. From 1998-2007, she served as a Trustee of the WM Group of Funds. Ms. Blake has been a director of the Russell Investment Funds since 2000. Through her education, experience as a director of mutual funds and employment experience, Ms. Blake is experienced with financial, accounting, regulatory and investment matters.

Craig DamosDamos.. Mr. Damos has served as a Directoran Independent Board Member of PVC and PFIthe Fund Complex since 2008. Since 2011, Mr. Damos has served as the President of TheC.P. Damos Company (consulting services)Consulting, LLC (doing business as Craig Damos Consulting). He has also served as a director of the employees' stock ownership plan of the Baker Group since 2020. Mr. Damos served as President and Chief Executive Officer of Weitz Company from 2006-2010 and2006 to 2010; Vertical Growth Officer of Weitz Company from 2004-2006. From 2000-2004, he served as the2004 to 2006; and Chief Financial Officer of Weitz Company.Company from 2000 to 2004. From 2005-2008,2005 to 2008, Mr. Damos served as a director of West Bank. Through his education, employment experience, and experience as a director of Principal Funds and employment experience,board member, Mr. Damos is experienced with financial, accounting, regulatory and investment matters.

Katharin S. Dyer. Richard W. Gilbert. Mr. GilbertMs. Dyer has served as a Director of PVC and PFI since 2000. From 1988-1993, he served as the Chairmanan Independent Board Member of the BoardFund Complex since January 2023. She is the founder and Chief Executive Officer of PivotWise, a firm providing strategic advice focused on digital transformation. Ms. Dyer currently serves as a director of Liquidity Services and the Federal Home Loan Bank of Chicago. Since 2005, Mr. Gilbert hasGrameen Foundation. She previously served as a director of Calamos AssetProvidence Health from 2019 to 2021, Noora Health from 2018 to 2021, YWCA of Nashville and Middle Tennessee from 2016 to 2022, and CARE from 2001 to 2013. She was formerly employed by IBM Global Services as a Global Partner and a member of the senior leadership team from 2016 to 2018. Ms. Dyer was a member of the Global Management Inc.Team at American Express Company from 2013 to 2015. Through his serviceher education, employment experience, and experience as a board member, Ms. Dyer is experienced with financial, information and digital technology, investment, and regulatory matters.

Frances P. Grieb. Ms. Grieb has served as an Independent Board Member of the Fund Complex since January 2023. Ms. Grieb currently serves as a director of Principal FundsFirst Interstate BancSystem, Inc. and his employment experience, Mr. Gilbert is experienced with financial, regulatory and investment matters.

Mark A. Grimmett. Mr. Grimmett has served as a Directorthe National Advisory Board of PVC and PFI since 2004. Hethe College of Business at the University of Nebraska at Omaha. She is a certified public accountant. Since 1996, Mr. Grimmett hasmember of the American Institute of Certified Public Accountants and the National Association of Corporate Directors. From 2014 to 2022, she served as the Chief Financial Officer for Merle Norman Cosmetics, Inc. Through his service as a director of Principal Funds, hisGreat Western Bancorp, Inc. Ms. Grieb is a retired partner having served in various leadership roles at Deloitte LLP from 1982 to 2010. Ms. Grieb is a retired Certified Public Accountant. Through her education, and his employment experience, Mr. Grimmettand experience as a board member, Ms. Grieb is experienced with financial, accounting, regulatoryinvestment, and investmentregulatory matters.

Fritz HirschS. Hirsch.. Mr. Hirsch has served as a Directoran Independent Board Member of PVC and PFIthe Fund Complex since 2005. From 1983-1985, he2011 to 2015, Mr. Hirsch served as Chief Financial OfficerCEO of Sassy, Inc. From 1986-2009, Mr. HirschMAM USA. He served as President and Chief Executive Officer of Sassy, Inc. from 1986 to 2009, and Chief Financial Officer of Sassy, Inc. from 1983 to 1985. Through his education, employment experience, and experience as a director of the Principal Funds and employment experience,board member, Mr. Hirsch is experienced with financial, accounting, regulatory and investment matters.

Victor L. Hymes.Tao Huang. Mr. Huang will begin serving as a director of PFI and PVC in March 2012. From 1996-2000, Mr. HuangHymes has served as an Independent Board Member of the Fund Complex since 2020. He currently serves as Founder, Chief TechnologyExecutive Officer, and Chief Investment Officer of Morningstar,Legato Capital Management, LLC. Over the past thirty years, Mr. Hymes has served in the roles of CEO, COO, CIO, portfolio manager and other senior management positions with investment management firms, including Zurich Scudder Investments, Inc., Goldman, Sachs & Co., and from 1998-2000 as President ofKidder, Peabody & Co. Mr. Hymes has served on numerous boards, and has chaired four investment committees over the International Division of Morningstar. From 2000-2011, Mr. Huang served as Chief Operating Officer of Morningstar. past two decades.Through his education, and employment experience Mr. Huang is experienced with technology, financial, regulatory and investment matters.

William Kimball. Mr. Kimball has served as a Director of PVC and PFI since 2000. From 1998-2004, Mr. Kimball served as Chairman and CEO of Medicap Pharmacies, Inc. Prior to 1998, he served as President and CEO of Medicap. Since 2004, Mr. Kimball has served as director of Casey's General Stores, Inc. Through his experience as a director of the Principal Funds and his employment experience,board member, Mr. Kimball is experienced with financial, regulatory and investment matters.Barbara Lukavsky. Ms. Lukavsky has served as a Director of PVC and PFI since 1993. Ms. Lukavsky founded Barbican Enterprises, Inc. and since 1994 has served as its President and CEO. Through her experience as a director

of the Principal Funds and employment experience, Ms. Lukavsky is experienced with financial, regulatory, marketing and investment matters.

Daniel Pavelich. Mr. Pavelich has served as a Director of PVC and PFI since 2007. From 1998-2007, Mr. Pavelich served as a Trustee of the WM Group of Funds. From 1996-1999, he served as Chairman and CEO of BDO and as its Chairman from 1994-1996. Through his education, experience as a director of mutual funds and his employment experience, Mr. PavelichHymes is experienced with financial, accounting, regulatory, and investment matters.

Interested Directors

Padelford L. Lattimer.Michael J. Beer. Mr. Beer will begin serving as a Director of PFI and PVC in June 2012, following election by shareholders. Mr. BeerLattimer has served as Executivean Independent Board Member of the Fund Complex since 2020. He currently serves as Managing Partner for TBA Management Consulting LLC. For more than twenty years, Mr. Lattimer served in various capacities at financial services companies, including as a senior managing director for TIAA Cref Asset Management (2004-2010), First Vice President at Mellon Financial Corporation (2002-2004), and in product management roles at Citibank (2000-2002). Through his education, employment experience and experience as a board member, Mr. Lattimer is experienced with financial, regulatory and investment matters.